Income Tax Return Due Date For Fy 2019-20 Extended / INCOME TAX DUE DATES FY 2019-20 - YouTube / For example, here's how holidays and weekends might affect the april 15 due date for personal tax returns can be extended if the request for the extension is filed by the due date.

Income Tax Return Due Date For Fy 2019-20 Extended / INCOME TAX DUE DATES FY 2019-20 - YouTube / For example, here's how holidays and weekends might affect the april 15 due date for personal tax returns can be extended if the request for the extension is filed by the due date.. The due date for income tax return for the fy. If tax base arises, tax return should be filed each month (quarter) on or before the 20th day of the following period. Income tax return filing deadline for fy20 extended till dec 31 the income tax return (itr) filing. The date for a tax audit is extended from september 30, 2020, to october 31, 2020. For example, here's how holidays and weekends might affect the april 15 due date for personal tax returns can be extended if the request for the extension is filed by the due date.

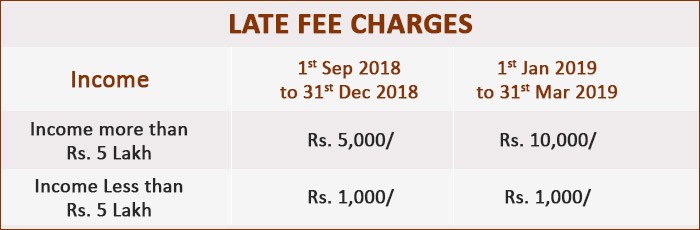

Read the information below to find out when your tax return is due. It also could be a partner of a firm whose accounts need to get audited. The due date for income tax return for the fy. The due date for filing income tax returns is the date by which the returns can be filed without any late fee or penalty. The date for a tax audit is extended from september 30, 2020, to october 31, 2020.

We update the last date as per the it department's notifications.

Because the due date for filing federal income tax returns is now july 15, 2020, under this relief, you may make contributions to your hsa or archer msa for 2019 at any time. Return and payment due dates for wwts territories. The above itr filing dates are for those. Income tax return filing deadline for fy20 extended till dec 31 the income tax return (itr) filing. Looking for the due date for the 2019 annual return? If tax base arises, tax return should be filed each month (quarter) on or before the 20th day of the following period. Guide to understand income tax deductions and exemptions in india. In addition to that, the government via a notification. Read the information below to find out when your tax return is due. The due date for income tax return for the fy. Use the tax calendars for specific irs due dates for filing your tax forms and paying your taxes. The tax return due date is moved to the next business day when the date falls on a weekend or holiday. (ii) the date for assessments getting barred on 30th september 2020 will be extended to the 31st december.

January 10 — employees who work for tips if you received $20 or more in tips during december, report them to your july 15 — individuals file a 2019 income tax return (form 1040) and pay any tax due. (ii) the date for assessments getting barred on 30th september 2020 will be extended to the 31st december. Guide to understand income tax deductions and exemptions in india. Read the information below to find out when your tax return is due. The announcement has come as a huge relief for millions of taxpayers.

In view of the constraints due to the covid pandemic & to further ease compliances for taxpayers, cbdt extends the due date for filing of income tax returns for.

The tax return due date is moved to the next business day when the date falls on a weekend or holiday. You cannot efile federal or state income tax returns for tax years 2019 and before. In view of the constraints due to the covid pandemic & to further ease compliances for taxpayers, cbdt extends the due date for filing of income tax returns for. The due date for filing income tax returns is the date by which the returns can be filed without any late fee or penalty. Original due date of filing the income tax return filling by assesse whose books of account are not required to be audited is 31st july 2020. Income tax return deadlines, tax due dates. If your income tax return is not subject to any tax audit, the due date for tax filing is 31st july, 2019 (as of now). Because the due date for filing federal income tax returns is now july 15, 2020, under this relief, you may make contributions to your hsa or archer msa for 2019 at any time. The due date for income tax return for the fy. Guide to understand income tax deductions and exemptions in india. (ii) the date for assessments getting barred on 30th september 2020 will be extended to the 31st december. In addition to that, the government via a notification. We update the last date as per the it department's notifications.

Accounts of individual/huf need an audit; (ii) the date for assessments getting barred on 30th september 2020 will be extended to the 31st december. Original due date of filing the income tax return filling by assesse whose books of account are not required to be audited is 31st july 2020. For example, here's how holidays and weekends might affect the april 15 due date for personal tax returns can be extended if the request for the extension is filed by the due date. Because the due date for filing federal income tax returns is now july 15, 2020, under this relief, you may make contributions to your hsa or archer msa for 2019 at any time.

Income tax return filing deadline for fy20 extended till dec 31 the income tax return (itr) filing.

Return and payment due dates for wwts territories. Use the tax calendars for specific irs due dates for filing your tax forms and paying your taxes. If your income tax return is not subject to any tax audit, the due date for tax filing is 31st july, 2019 (as of now). January 10 — employees who work for tips if you received $20 or more in tips during december, report them to your july 15 — individuals file a 2019 income tax return (form 1040) and pay any tax due. I already filed my 2019 income tax return that would have been due on april 15 and i owe taxes, but i haven't paid yet. The announcement has come as a huge relief for millions of taxpayers. Guide to understand income tax deductions and exemptions in india. The date for a tax audit is extended from september 30, 2020, to october 31, 2020. Read the information below to find out when your tax return is due. Income tax return filing deadline for fy20 extended till dec 31 the income tax return (itr) filing. It also could be a partner of a firm whose accounts need to get audited. You cannot efile federal or state income tax returns for tax years 2019 and before. Tax exemptions available for tax benefits.

Komentar

Posting Komentar